To see what Databox can do for you, including how it helps you track and visualize your performance data in real-time, check out our home page. Click here.

To make informed financial decisions in your company, you first have to be, well, informed.

Understanding the financial activity of your company sets the foundation for identifying good business opportunities and making the right decisions to ensure future growth.

By tracking, organizing, and analyzing financial performances, you will have a clearer picture of where the money is going and where it’s coming from. No wonder finance is one of the most monitored and reported operations, according to Databox’s State of Business Reporting.

To stay on top of numbers, companies use financial reports.

Financial reports are formal documents that capture all the significant financial activities within a business in a specific period.

While these reports are extremely useful for you and your key stakeholders, you won’t be the only one reaping the fruits. Financial statements are also examined by potential investors and banks since they provide them with enough insight to determine whether they want to invest in your business.

In this article, we are going to walk you through what financial reports are, why they are significant and show you a step-by-step guide that will take your financial reports and business reporting as a whole, to the next level.

Financial reports are official company documents that showcase all the financial activities and performances of your business over a specific period. Usually, they are created on a quarterly or yearly basis.

Every business is legally obliged to use financial reporting to display its current financial status and organize financial data.

The documents are available for public view which means that potential banks and investors will most likely analyze them before they decide to work with you and invest in your business.

They are also important for tracking future profitability estimates, business growth, and overall financial health.

At bottom, financial reports provide you with insight into how much money you have, how much did you spend, and where it is coming from. Based on the data within the report, you can make informed business decisions and create plans for future spending.

The key things a financial report should include are:

Understanding how your business is performing from a financial standpoint can seem like an impossible task without these reports.

However, financial reports aren’t used only because they are practical; you are legally required to include them.

Here are some of the main ways in which financial reports can help your business:

Having an insight into the current financial situation of your business is important to each high-ranking member of the company (stakeholders, executives, investors, and partners).

You will use this financial data to create budget plans and monitor the company’s overall performance. When you establish an open communication and transparency policy within your business, you are more likely to attract new investors and enhance funding.

The information communicated in financial statements is what investors rely on when they are assessing risks, profitability, and future returns.

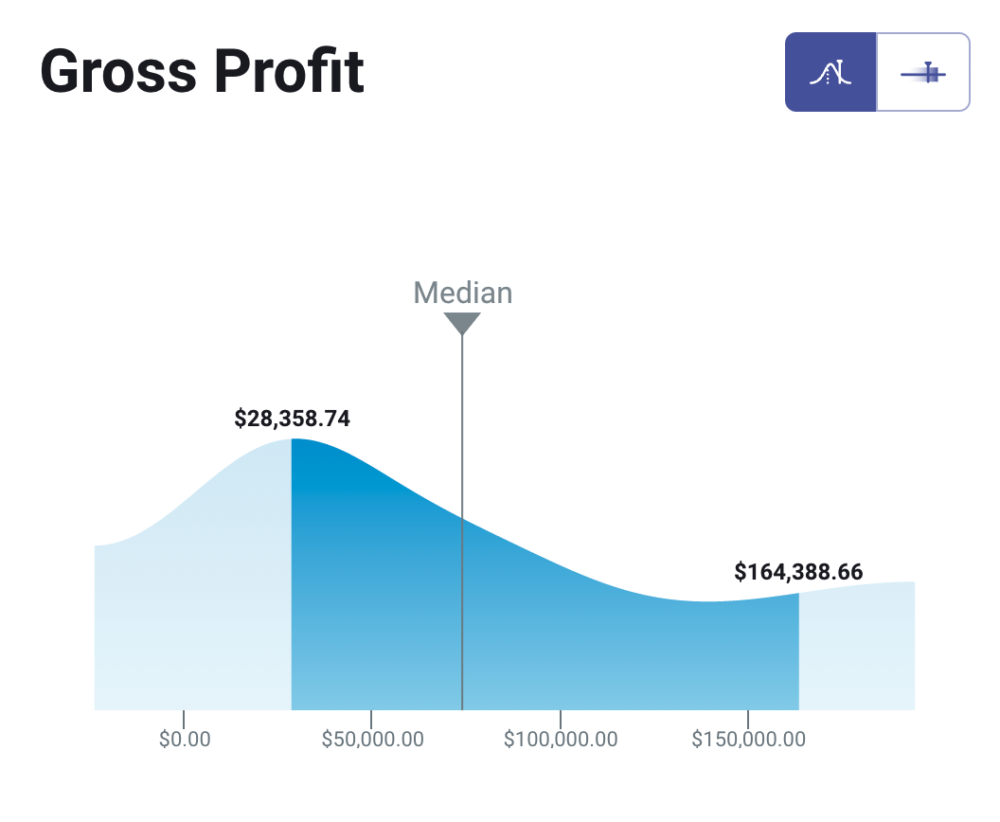

One way to gain the trust of investors is to showcase how your financial performance stacks up against your peers. For example, by joining this benchmark group, you can better understand your gross profit margin performance and see how metrics like income, gross profit, net income, net operating increase, etc compare against businesses like yours.

For example, you can discover that the median gross profit a month for B2B, B2C, SaaS and eCommerce is 73.79K. If you perform better than the median, this might be a good incentive for your investors to increase your funding.

*Important note: Databox Benchmark Groups show median values. The median is calculated by taking the “middle” value, the value for which half of the observations are larger and half are smaller. The average is calculated by adding up all of the individual values and dividing this total by the number of observations. While both are measures of central tendency, when there is a possibility of extreme values, the median is generally the better measure to use.

Viewing benchmark data can be enlightening, but seeing where your company’s efforts rank against those benchmarks can be game-changing.

Browse Databox’s open Benchmark Groups and join ones relevant to your business to get free and instant performance benchmarks.