Online customers no longer have to rely on their credit or debit card for every payment, thanks to new payment methods and options. They can just as easily opt for easier payment solutions such as Apple Pay or Google Pay. Even then, the quality and efficiency of the checkout process offered by the online store determine whether the customer will even proceed with the payment. No wonder, the online shopping cart abandonment rate has consistently remained around 70% since 2014. Optimizing the payment process is one of the effective ways to reduce the abandonment rate. So, what does payment optimization entail, and what are some of the popular strategies you can deploy for it – we will discuss all that and more.

Start Free Trial Highlight real-time activities like reviews, sales & sign-ups.

Add to My Website Now

eCommerce payment process optimization includes taking measures such as improving your payment strategy, technological infrastructure, and processing logic. These measures are generally taken to reduce overall costs, minimize instances of fraud, and improve authorization rates among other things. Payment optimization focuses on delivering a seamless customer experience while processing their payments without any issues.

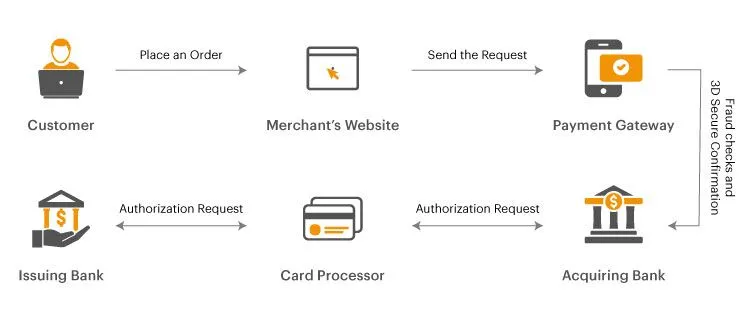

As newer modes and methods of payment keep popping up, payment processing is getting more complex. So, eCommerce stores with optimized payment processes can gain an edge over competitors. Here’s how a typical payment process of an eCommerce company looks: Source Two things that can negatively impact the performance of your eCommerce store are having too many javascript errors derailing your user experience, and lack of payment optimization making the process of placing an order quite complex for customers. That said, here are a few benefits that you can achieve with the help of payment optimization:

With the aforementioned benefits becoming so accessible with the help of payment optimization, it is a good idea to implement strong payment optimization strategies.

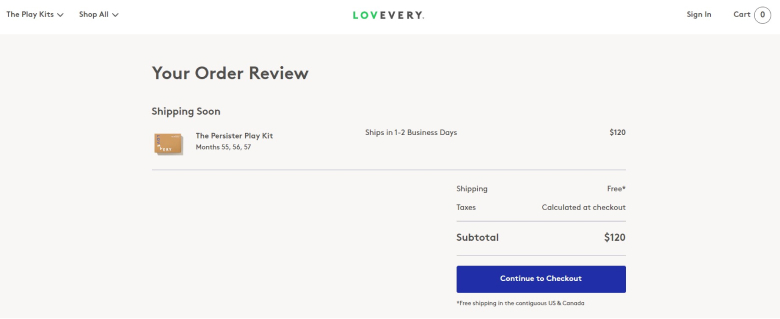

The easiest way to implement a simple and straightforward checkout process is to reduce the number of steps involved in completing a purchase.

A standard checkout process can involve multiple steps such as enabling guest checkouts, minimizing fields in forms, and even using progress indicators to reassure customers.

All of these steps can work towards improving the checkout process of your online store, and reduce cart abandonment as well as improve customer satisfaction and experience.

Consumer preferences can vary when it comes to their go-to payment method.

It is a good idea for eCommerce stores to offer payment options such as credit/debit cards, digital wallets, and even alternative methods such as BNPL (Buy-Now-Pay-Later).

Having multiple options for accepting payments helps you ensure that you cater to different customer preferences and even increases the chances of having completed transactions.

Ensuring mobile-friendliness and optimization is not only necessary for your website but also for your payments.

As an eCommerce store, you need to ensure that your payment gateway and checkout process are mobile-friendly and that your payment systems are equipped to handle mobile payments.

Other than that, you should ensure to deliver a seamless mobile payment experience considering the increasing use of mobile devices for shopping.

What’s more, effective mobile payment processes are instrumental in getting more sales out of your mobile users.

While you may not be able to secure every single customer transaction, you can take security measures to manage customer data and ensure that most of their payments are secured.

As an online store owner, you want to implement SSL encryption, PCI-DSS compliance, and even integrate two-factor authentication for payments on your website.

These safety and security mechanisms will help you reduce incidents of chargebacks and fraudulent transactions, while the additional security will offer assurance to customers.

One of the primary factors that contribute to bottlenecks in the payment process is customers not having enough clarity on how to navigate it.

To avoid this kind of issue, ensure that you provide clear and concise instructions to your customers.

If not, ambiguity in this stage can lead to customer frustration or payment abandonment – both of which suggest that your payment process is not at par with their expectations.

Ensure to include detailed error messages, navigational cues as well as troubleshooting and guidance for potential payment issues such as declined payments.

Letting the customer save their payment information will not only improve their shopping experience but also your relationship with the customer.

Saving payment details for future purchases also speeds up the checkout process for subsequent transactions, which would increase the likelihood of the customer returning for a purchase.

However, you should ensure compliance with data protection regulations while optimizing payments.

The bitter truth you need to acknowledge right away is that no one likes to deal with slow or suspicious payment providers.

It raises an immediate red flag in the customers’ minds and leads to abandonment.

Instead, choose reliable payment gateways that guarantee fast and secure transactions.

You can choose from popular payment gateway options and switch to a more reliable one that will minimize transaction failures and improve customer trust.

If you want to truly optimize your payment process to please customers, it is a good idea to actively track and monitor payment-related metrics.

Equipped with insights informed by this data and analytics, you will get valuable insights into your customers’ payment behavior, and the common dropoff points, and even detect fraudulent activities.

A lot of eCommerce stores have discounts or offer-related loopholes that customers end up exploiting.

With payment analytics, you will be able to identify and eliminate such vulnerabilities right away.

In the end, you can create a fully optimized payment process that will fulfill your and your customer’s expectations.

For eCommerce stores that cater to an international audience, simply making your website available in their region or localizing the content on it is not enough.

For instance, if a UK-based customer is visiting your Australia-based eCommerce store, and can see the prices in AUD, they might assume you do not cater to their region and abandon the website.

If not, they would at the very least be confused over conversion rates and additional transaction fees.

To save them all this trouble, enable customers to pay in their local currency by integrating a multi-currency payment gateway.

This makes international transactions and shopping more appealing and efficient.

If your website sells a lot of high-ticket items that customers may not be able to pay upfront and buy, offer post-purchase payment options to help them out.

These options include installment plans or subscription billing so that expensive products become more accessible.

More importantly, if customers know about these payment options, they are less likely to abandon their shopping journey.

The first step in any payment optimization process is assessing the status quo of your current payment processing system.

It is important to assess and document each step of the process and the features associated with them so you can get a clearer picture of what needs to be changed.

Based on your analysis of the current payment processing system, you may have identified certain areas of improvement.

You can also circulate surveys and forms to gain a better understanding of your customer’s preferences in an ideal payment system. Document all of the insights you gain from these steps.

Now that you have understood what needs to be changed in your payment processing system, the only thing left to do is implement those changes and facilitate successful transactions.

Once you implement all the necessary changes in your payment process, implement and see how the new system performs by assigning KPIs.

Once the changed and optimized payment system is in place, you need to ensure that it solves the issues you identified earlier.

You also want to be sure that it consistently performs better than the previous system in the long run.

To accomplish all of this, you will monitor and track the performance metrics for the new payment system and make improvements as required.

Start Free Trial

Highlight real-time activities like reviews, sales & sign-ups.

Add to My Website Now

Payment Collection Platforms or payment gateways are necessary mediators for processing the payments of your customers.

Here are the three best eCommerce payment gateways to consider:

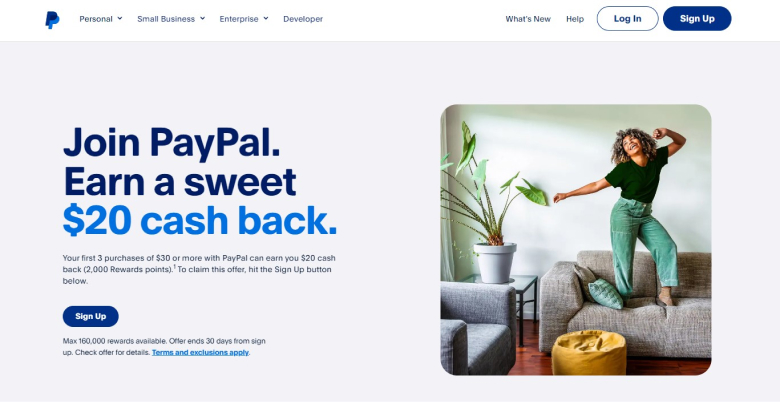

Ideal for small businesses and online stores, PayPal is a widely recognized payment gateway that is easy to set up without any setup costs.

The platform offers several features for empowering seamless checkouts and ensuring the security of customer’s information.

The platform is available in over 200 countries and supports 25 currencies.

The payment processing fee ranges from 2.59% + fixed fee.

Stripe is one of the most popular and best payment collection platforms, and for good reason.

It caters to not only online retailers but also to marketplaces and subscription businesses dealing with global payments.

Even with no subscription fee, Stripe offers unique features aimed towards online sales, by allowing integration with multiple eCommerce platforms, operates in over 46 countries, and accepts over 135 currencies thus helping in international sales.

The payment processing costs range from 2.9% + 30 cents. There are additional fees for international cards, manually entered cards, and currency conversions.

Perfect for small and mid-sized businesses, Square is yet another reputed payment collection platform acting as a mediator between you and banks.

Square offers sophisticated security features, and even inventory management features that can help you with sales reporting.

With no subscription fee, Square supports 27 currencies and is available in the following countries: UK, USA, Japan, Canada, Australia and Ireland.

The payment processing fees for Square start from 2.6% + 10 cents.

Along with understanding what to do to get your payment optimization right, here are some of the mistakes you should keep in mind:

1. No Consideration of Local Payment Preferences

One of the biggest mistakes you can make as an online store is not to consider your customers’ payment preferences.

If you are serving international customers but not letting them pay with their currency, they might abandon you for another local online store that does.

2. Minimal Variety in Payment Options

Similarly, not offering a variety of payment options to customers would be a big mistake for any online store.

Providing enough options ensures that your customers do not leave as a result of being unable to pay with their preferred payment method.

Imagine offering them the option to pay by credit or debit card when your customers prefer bank transfers or Venmo.

3. Asking For a Lot of Information

In an age where customers’ personal information is susceptible to unauthorized access by malicious parties, asking for too much information is not advisable.

It is always a good idea to take only the information you need to process the payment.

4. Adding Too Many Steps in the Process

If your payment operations are extensive and require your customers to fill in endless fields, they are likely to get frustrated and abandon the order.

Try to optimize your checkout process so that it has minimal steps for payment.